The UK government is intensifying its approach to tackling forced labour through new procurement regulations and a review of responsible business conduct

The UK Government is intensifying its approach to tackling forced labour within supply chains through a cross-departmental review of Responsible Business Conduct (RBC) and new public procurement regulations.

The direction of policy is towards stronger expectations on due diligence, more assertive use of procurement powers and closer alignment with international trading partners.

For C-level executives and chief procurement officers, it signals a need to treat labour risk as a strategic issue rather than a matter of compliance.

Sir Chris Bryant MP, Minister of State for Trade, says: “Forced labour is an egregious and severe violation of human rights. The abhorrent practice of forced labour has no place in UK supply chains and the global economy.”

Procurement Act’s ‘debarment list’

Under the new Procurement Act, a central debarment list is now active targeting suppliers connected to modern slavery.

This means major changes in public procurement. Contracting authorities are now subject to a more stringent exclusion regime and have a duty to notify the Procurement Review Unit of any relevant cases.

This development requires procurement leaders to ensure their supplier vetting and onboarding processes are aligned with this new central database to avoid engaging with debarred entities.

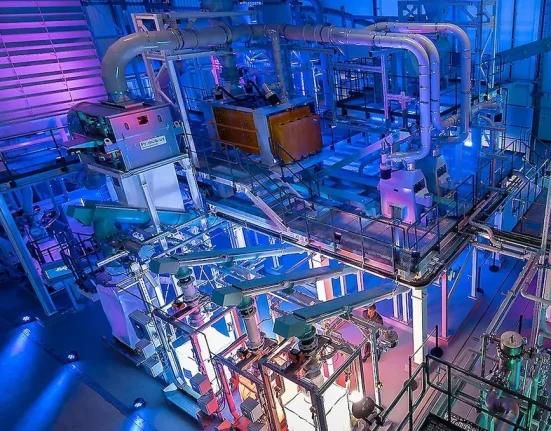

In the energy sector, Great British Energy (GBE) has been tasked with establishing ethical supply chain practices. GBE is mandated to publish its own modern slavery statement and to use contract termination powers if links to forced labour are discovered.

It will report progress in its first annual report by July 2026, creating an early benchmark for governance and transparency that other sectors will likely be measured against.

RBC review

The government’s Responsible Business Conduct (RBC) review is currently exploring several options to strengthen corporate accountability. These include the potential for mandatory human rights and environmental due diligence obligations for businesses.

The review is also assessing the viability of import controls and the enforcement model required to give these new rules authority. The details regarding penalties and regulatory oversight will be decided by ministers upon the review’s conclusion.

This work is being led by the newly-formed Office for Responsible Business Conduct (ORBC), which is responsible for coordinating government efforts on supply chain harms. Additionally the government is considering enhanced reporting rules potentially extending obligations to public sector bodies and introducing penalties for non-compliance.

According to government information, the current reporting threshold referenced is an annual turnover of about US$46m, meaning the focus remains on larger firms while expectations of cascading due diligence through supply tiers will grow.

Trade policy and sector-specific scrutiny

Trade policy will continue to be a key tool, with the government embedding forced-labour provisions into its Free Trade Agreements (FTAs). These agreements allow for recourse to implementation forums and dispute processes if obligations are not met.

The UK has already held labour discussions focused on forced labour with 14 FTA partners which could indicate a move towards a stricter international baseline for supply chain conduct.

Clean energy has been identified as a priority area for these new measures. The Department for Energy Security and Net Zero (DESNZ) plans to embed ethical supply chain requirements into its growth strategies. While the government has welcomed industry-led initiatives like the Solar Stewardship Initiative it has stated that public procurement will not depend on this alone.

Standards will be continuously reviewed and action will be taken if compliance gaps are found.

A refreshed critical minerals strategy due in 2025 also aims to enhance responsible and transparent sourcing across these vital inputs. Procurement leaders in sectors with known exposure such as solar, electronics, garments and critical minerals should anticipate that buyers will expect clear evidence of progress on due diligence.

Leave feedback about this